No more masters: the future of floorplans

When the phrase “master bedroom” first came into use, the homebuying industry heavily favored white, cisgendered men.

Read more

about No more masters: the future of floorplans

When the phrase “master bedroom” first came into use, the homebuying industry heavily favored white, cisgendered men.

Read more

about No more masters: the future of floorplans

Refinancing your mortgage? You may want to buy down your interest rate by purchasing points, which can save you thousands over the life of your loan.

Read more

about A guide to refinance points

A rush of lower-priced homes are being listed by homeowners coming out of forbearance plans. The new supply should open up more options for today’s homebuyers.

Read more

about More affordable homes are hitting the market

A guide to navigating first time homebuyer loans, grants, and programs to make sure you get the most bang for your buck.

Read more

about Loan, grants, & programs, oh my! Navigating first time homebuyer loan resources

A new announcement from the Federal Reserve could mean the end of low rates—but that may not be bad news for buyers and homeowners.

Read more

about The Fed decision will likely drive rates up

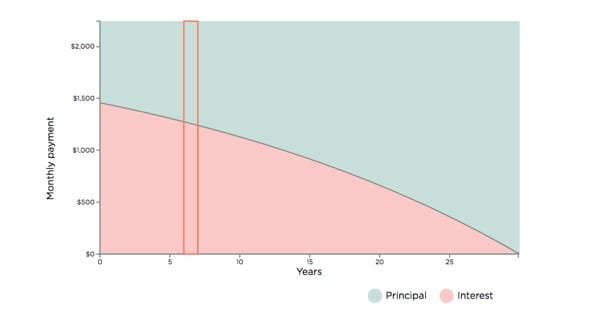

Try this interactive amortization calculator to find the amortization schedule for any fixed-rate mortgage.

Read more

about Free mortgage amortization calculator and table

Can you still buy a home if you have student loan debt? Turns out you have some options. Here’s what you should know about getting a mortgage.

Read more

about Yes, you can buy a home—even with student loans!

A lot goes into making an offer on a home. Here are the 6 steps—from determining your price to sealing the deal.

Read more

about How to make an offer sellers won't want to refuse

Home prices continue to rise, but the holiday season could spell opportunity for some. See multiple ways first-time buyers can get a competitive edge.

Read more

about Here’s what first-time homebuyers priced out of the market need to know

Learn how to compare mortgages, first-time homebuyer assistance programs to apply for, and why the amount you’re pre-approved for shouldn’t be your offer price.

Read more

about First Time Buying a Home? Avoid These 6 Common Mistakes

Mortgage News: Rates are likely to inch upward between now and the end of the year. Find out how inflation is driving the rise, and how you can lock in...

Read more

about What inflation means for refinance rates

Mortgage News: Over a million homes are expected to sell in the next two months alone. Find out how to get serious about your house hunt so you can score...

Read more

about How to get serious about your house hunt

Homebuyers are paying more at closing than they did in 2020, but choosing the right lender and loan options can help you save on a new home.

Read more

about How to save on rising closing costs

Closing costs are going up around the country, but choosing the right lender can help you save more on a new loan.

Read more

about Here’s how to save when you close a refinance

The highest offer doesn’t always win, and there are ways to win against all-cash buyers. Here’s how to win a bidding war on a house to get the home you...

Read more

about How to win a real estate bidding war in a competitive market

Use mortgage points to buy down your interest rate when purchasing or refinancing a home. Learn how it lowers interest rates and saves you money over time.

Read more

about What are mortgage points?

We looked at notable design trends over the past 100 years to see how American homes have changed.

Read more

about Interior design trends from the 1920s to today

Here’s how much home prices and average interest rates have risen since 1950.

Read more

about Here's how much home prices have risen since 1950

A jumbo loan refinance is needed when you have a high mortgage balance. Learn about the qualifications, closing costs, and when it may be worth it.

Read more

about Could a jumbo loan refinance deliver jumbo savings?

To help buyers keep up with record high home prices, the FHFA is raising the limit on conforming loans—and it could help you save on a home.

Read more

about Conforming loan limits are going upNeed something else? You can find more info in our FAQ