Finding Home: Sandra

A recently divorced single mom uses Better’s Cash Offer to get a home for her family lightning quick.

Read more

about Finding Home: Sandra

A recently divorced single mom uses Better’s Cash Offer to get a home for her family lightning quick.

Read more

about Finding Home: Sandra

A newly married couple buys a home to put down roots near family and connect with their community.

Read more

about Finding Home: Mateo and Ale

A veteran and her wife find a lender and put an offer on their dream home 7 hours after seeing it—the rest is history.

Read more

about Finding Home: Shaina and Tessa

Newlyweds take the plunge on their first home with Better’s Cash Offer program.

Read more

about Finding Home: Dorian and Leah

Conventional loans offer plenty of perks. But which is best? Our overview of different types of conventional loans will help you pick the best one for you.

Read more

about Which Loan Fits Your Needs? Types of Conventional Loans: An Overview

Better compiled a list of 15 events and milestones in the history of the American mortgage system, using information from news articles, encyclopedias, and historical literature.

Read more

about History of the American mortgage

Better analyzed U.S. Census Bureau data to determine how homeownership rates have changed over the past 25 years.

Read more

about How homeownership rates changed over the past 25 years

Buying a home isn’t impossible for low income families. In fact, there are loans designed to help. Learn which ones to look for in our low income loan guide.

Read more

about 6 loans for buying a house with low income

Have a lower credit score and down payment? An FHA loan can help you buy a home. See how to qualify, first-time homebuyer benefits, and steps to get it done.

Read more

about How to get an FHA first-time homebuyer loan

Here are the counties where mortgage payments have jumped the most in the past 2 years.

Read more

about Counties where mortgage payments have jumped the most in the past two years

Conventional loans are the most common mortgage type in the US. Here we explain what makes them different from other mortgage options and how to get one.

Read more

about Conventional Loans: Pros, cons, and tips for qualifying

Yes, you can use money in a 401(k) account to buy a house. But should you? Learn whether it makes sense to use your 401(k) for a down payment and...

Read more

about Can I use a 401(k) to buy a house?

A doctor and single parent, forced to downsize after divorce, navigates debt and damaged credit to provide a safe home for her family.

Read more

about Finding Home: Taisha

Why wait, save, and pay rent to your landlord when you could be paying off your own home. See why smaller down payments can unlock the door to homeownership.

Read more

about Understanding the minimum down payment for conventional loans: when 3%, 5%, or 10% is the best choice

Ready to buy your first home? Here’s how much you’ll need for a down payment, and how to budget for it appropriately.

Read more

about First time homebuyer down payment ins and outs

When the phrase “master bedroom” first came into use, the homebuying industry heavily favored white, cisgendered men.

Read more

about No more masters: the future of floorplans

A guide to navigating first time homebuyer loans, grants, and programs to make sure you get the most bang for your buck.

Read more

about Loan, grants, & programs, oh my! Navigating first time homebuyer loan resources

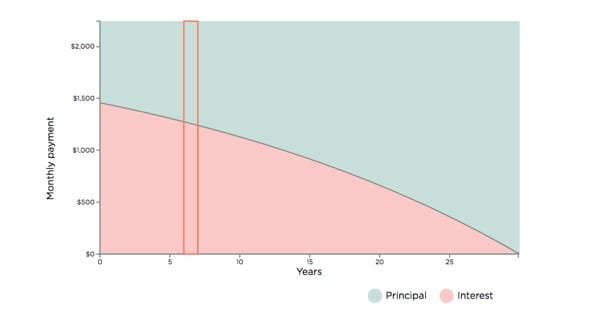

Try this interactive amortization calculator to find the amortization schedule for any fixed-rate mortgage.

Read more

about Free mortgage amortization calculator and table

Can you still buy a home if you have student loan debt? Turns out you have some options. Here’s what you should know about getting a mortgage.

Read more

about Yes, you can buy a home—even with student loans!

A lot goes into making an offer on a home. Here are the 6 steps—from determining your price to sealing the deal.

Read more

about How to make an offer sellers won't want to refuseNeed something else? You can find more info in our FAQ