A guide to the underwriting process

Peek behind the curtain at Better Mortgage for insight into the underwriting process for mortgages, what underwriters look for when approving a loan, and more.

Read more

about A guide to the underwriting process

Peek behind the curtain at Better Mortgage for insight into the underwriting process for mortgages, what underwriters look for when approving a loan, and more.

Read more

about A guide to the underwriting process

Find out what makes Better a different kind of online mortgage lender. Our innovative technology, honest rates, and friendly humans are just the beginning.

Read more

about What Makes Better, Better

Mortgage News: Historical data and current trends suggest that homebuyers who sign early this winter are likely to get a better deal.

Read more

about Why this winter may be the best time to buy a home

As young families leave cities, young professionals and empty nesters eye downtown condos. Find the metros where condo prices have dropped the most.

Read more

about As families head to suburbs, young professionals and empty nesters eye downtown condos

Mortgage News: Stock prices are up and bond yields are up, which means mortgage rates are up, too. Where do they go from here? It all depends on the economy.

Read more

about Rates rise upon news of COVID-19 vaccines

Mortgage News: Rates hit a 12th all-time low of 2020 last week but, sustained record lows are looking less and less likely in light of recent events.

Read more

about Are record-breaking rates behind us?

Mortgage News: Rates dropped after Election Day, but they’re unlikely to remain stable for long. Here’s why you should expect rates to swing up and down, whatever the results.

Read more

about Post-election rates likely to seesaw

Wondering about the home appraisal process? Learn what it is, why it’s important, how to get prepared for a home appraisal, and how to make the most of your appraisal.

Read more

about A complete guide to what an appraisal is and the home appraisal process

Low interest rates and remote work are driving more millenials to purchase homes in affordable cities. Plus, the real estate industry embraces virtual tours.

Read more

about Millennials drive home sales as low rates fuel today’s growing demand for homeownership

Mortgage News: Home sales are steadily declining but buyers may be holding out for better prices.

Read more

about Home sales decline as more buyers plan future purchases

Mortgage News: The average 30-year fixed mortgage rate fell to 2.81% last week, hitting yet another all-time low.

Read more

about Mortgage rates hit 10th record low of 2020

Ever wondered what affects mortgage rates and which factors push them up and down? Better Mortgage breaks down the science.

Read more

about What affects mortgage rates: an economic breakdown

Extended remote policies have inspired a new wave of suburban homeowners as home prices break records.

Read more

about As remote workers trade urban rentals for suburban homes, median home price spikes

Mortgage News: Low inventory has driven the cost of homeownership through the roof, and price hikes are now deterring prospective buyers.

Read more

about High home prices are slowing sales despite low mortgage rates

Mortgage News: The average APR for refinances is still around 3%, defying expectations that the FHFA fee would drive it higher.

Read more

about Record-low refinance rates are still available in spite of FHFA fee

Mortgage terminology is important—and often confusing. We’ll explain interest rates vs. APR, good faith estimates vs. Loan Estimates, and title insurance and PMI.

Read more

about Your guide to commonly confused mortgage terminology

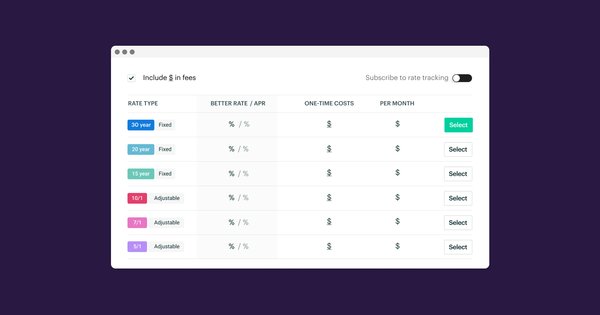

Learn how to read a mortgage rate table—a powerful comparison tool to help you choose the best home loan for your needs—in this new article from Better Mortgage.

Read more

about What to look for when comparing mortgage rates

Mortgage News: Over 19 million homeowners have the chance to save by refinancing as rates continue to hit historic lows.

Read more

about 19.3 million homeowners have the chance to save by refinancing

Second mortgages can be used to pay off debts, but they do come with risks. Learn about HELOCs, home equity loans, and piggyback loans in this new Better Mortgage article.

Read more

about When and why would I need a second mortgage?

Mortgage News: A new FHFA fee will raise the cost of refinancing in September despite criticism from the White House and industry leaders.

Read more

about What you need to know about the new FHFA refinance feeNeed something else? You can find more info in our FAQ